ERP for Finance Management

Finance

ERP Mangtaa Finance suite includes a core set of financial modules used by almost every organization. ERP Mangtaa Finance suite is designed for companies with complex requirements, with keeping in mind that they are easy to use in midsized and smaller organizations, who may have fewer finance management system requirements. The modules in the Finance suite are integrated with each other and also with the other ERP Mangtaa suites.

Workflow

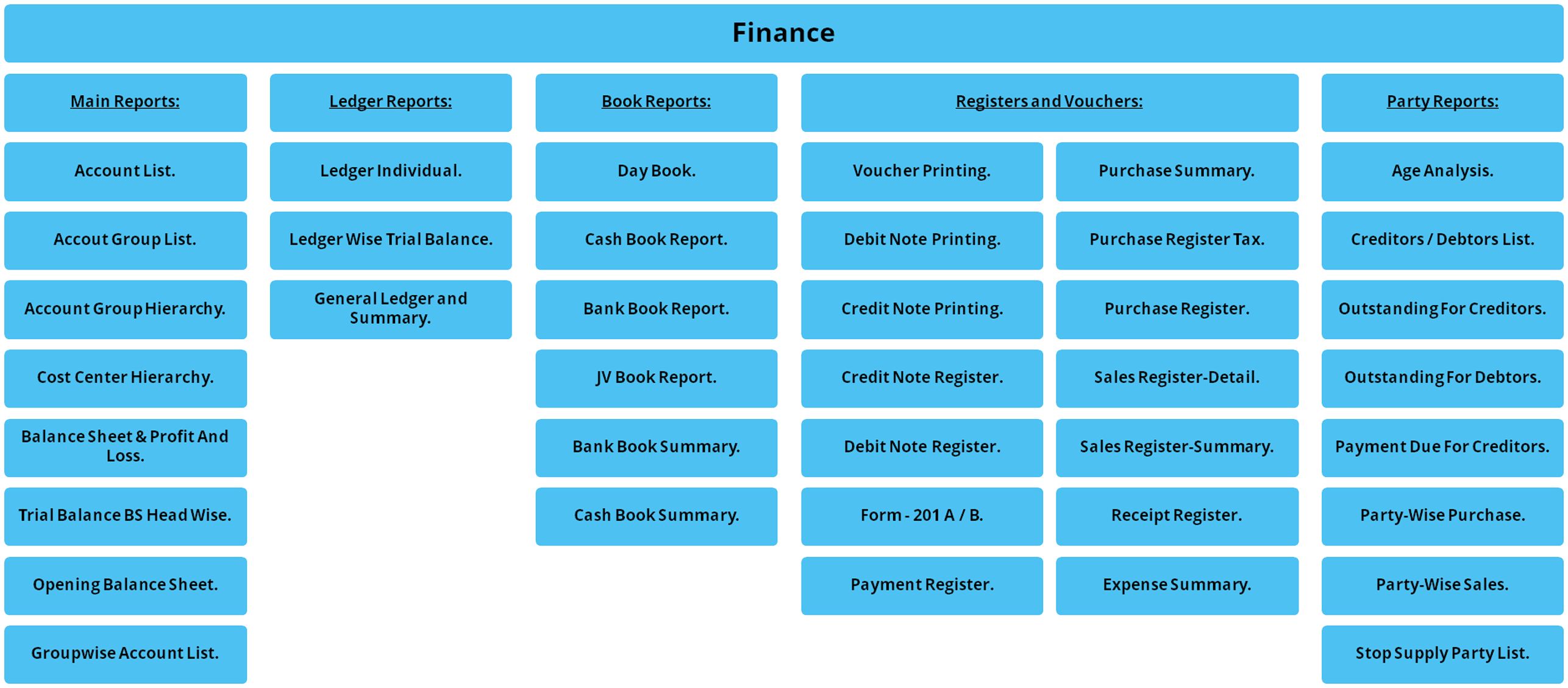

Below is a graphical explanation of the processes included in the Suit.

(*) This chart represents the entire Finance Suit covered by ERP Mangtaa.

Core Accounting

Core systems assist with the basic functions necessary to balance a business’ books, including basic functionality:

- General Ledger:

- Accounts Payable:

- Accounts Receivable:

- Fixed Assets:

- Bank Reconciliation:

Project Accounting

This type of system helps project-oriented businesses maximize job profitability and efficiency by tracking detailed project costs. Businesses can examine past job costs and estimate future costs to choose the jobs that will achieve adequate profit. It tracks by project factors like labor, overhead materials and equipment to improve decision-making.

Inventory Management

This type of solution helps companies keep the correct inventory levels to maximize profit, avoid overspending and minimize the costs associated with inventory depreciation. The right system keeps inventory information up-to-date by tracking product levels as well as orders, sales and deliveries. The Generally Accepted Accounting Principles stipulate specific ways to account for inventory to ensure proper reporting of value for inventory that has depreciated or undergone other changes.

Billing and invoicing

These systems automate the collection of payments from customers to enable timely and consistent collection with minimal human error. There are many different types of billing and invoice systems designed to support the wide range of industries, business models, payment methods and operational scales.

Budgeting And Forecasting

Users can leverage budgeting and forecasting solutions to project a company’s financial outlook from historical data and estimate future conditions. These systems are typically used in businesses that must consolidate multiple departmental forecasts and budgets, and are most helpful where multiple variables drive the ultimate forecast.

Fixed Asset Accounting

This type of system tracks fixed assets by providing a central database of important asset information, including location, check-in and check-out, due date for return, maintenance scheduling, audit history, cost and depreciation. Depreciation schedules are a core element of this specialty.

Payroll Management

Payroll systems help businesses track and process employee payrolls. They also compose and print paychecks, automatically withhold and pay government taxes and generate the necessary legal and tax reports on a regular basis. Automated reminders to pay required fees help businesses avoid legal penalties.

Reports

Few Reports included in the Suit.